Error message

|

Amy Namur, Young Professionals Program participant at the East-West Center in Washington, explains that “Often, China’s investments in coal-based infrastructure go against a country's national interest." |

Once known as the world's top carbon polluter, China has recently recommitted itself as a leader in sustainability and renewable energy. Moving to fill the gaps left by the United States at the Paris Climate Talks, China has ramped up its renewable energy commitments, including plans to cap its CO2 emissions, drastically increase forest stocks, and expand its non-fossil fuel market share to 20 percent, all by 2030. This move has been highly favorable for Chinese diplomatic relations with its Southeast and Pacific Island neighbors who have labeled climate change as a top priority. Domestically the extensive health impacts of air pollution in China has rallied public opinion against the pollution industry, making the move to green energy both a wide berth of support. While still the highest CO2 emitting country in the world, China has made significant investments in renewable energy development and currently leads the planet in renewable investments abroad. China’s domestic commitment to sustainability has been ambitious; however, meeting these goals has created one of the biggest energy paradoxes of the 21st century.

China’s economic growth continues to be heavily dependent on coal. As reported by the Center for Strategic and International Studies (CSIS), coal made up about 70 percent of the PRCs energy consumption between 1985 and 2016. With coal-fired energy producing up to twice as much CO2 as other fossil fuels, reliance on coal as a primary energy source can be costly in terms of CO2 emissions. According to data from the European Union (EU), China’s CO2 emissions made up just under 30 percent of the global total in 2017, making China’s emissions for the year greater than Africa, Latin America, and the European Union combined. For a country that produces over 3.53 billion tons of coal annually, slowing domestic production would not only put 2.3 million coal miners out of work by 2020, but also drastically harm China’s stagnating economy. In order to combat this, the PRC has adopted an unusual strategy: the exportation of carbon emissions.

Through the use of infrastructure investments, the PRC has been able to utilize its Belt and Road Initiative to invest in coal-based energy production throughout Southeast Asia, the Middle East, and Africa. Between 2000 and 2017, the Chinese Development Bank and the Export-Import Bank of China has financed $52 billion worth of coal projects overseas, effectively backing over one-quarter of all coal plants under development outside of China today according to data from Boston University's Global Development Policy Center. While foreign investments in renewable energies have certainly been on the rise for China, reaching $44 billion in 2017, they have yet to eclipse the PRC’s continued investments in coal.

Often, China’s investments in coal-based infrastructure go against a country's national interest. The Lamu Coal Power Station in Kenya, which was under construction by Power China and funded through Chinese banks, highlights this trend. For a country that has no preexisting coal-based infrastructure, the Lamu Power Station was a costly enigma. Not only would the power station increase Kenya’s greenhouse gas emissions by an estimated 700%, the plant would also be reliant on imported coal, making the power station far from viable. Today, construction of the Lamu Coal Power Station is stalled due to community and national intervention; however, the same cannot be said for Pakistan, which opened its doors to its first coal-fired power plant in 2019 due to similar investments from the PRC.

In Vietnam, Chinese firms have already built 15 coal-fired power plants, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA). Vietnam's decision to abandon its cleaner-burning nuclear power program in favor of coal-fired power can be linked to increasing Chinese investments in coal-based energy such as a recent investment in a 1.75 billion coal-fired power plant in Vinh Tan by China Southern Power Grid and China Power International Development Company. China’s involvement in Bangladesh has also reached new highs. As of May 2019, Chinese investments accounted for an estimated 78 percent of the country’s predicted coal-fired capacity in 2022. This amounts to 18.4 gigawatts of coal-fired energy production according to new figures by Greenpeace. However, as Bangladesh reaches the onset of an energy glut, the future of these projects is still uncertain.

As found by the IEEFA report, the biggest lenders for these coal-based projects are Chinese policy banks such as China Development Bank and China Export-Import Bank, with some investment backing coming from smaller state-owned commercial banks like the Bank of China. State-owned corporations such as the State Grid Corporation of China and China Energy Engineering Corporation are also key developers for out of state coal-based energy investments. These companies often act as engineering, procurement, and construction (EPC) contractors who typically take over operations once construction is finished. Additionally, these EPCs often employ a majority of Chinese workers leading to low levels of local job creation which can lead to conflicts, as seen in Indonesia in 2016.

As China works to meet its Paris agreement goals, an excess of domestic coal-based technology, infrastructure, and labor has started to accumulate within the PRC. If left within China, these assets have the potential to lead to massive opportunity costs, economic loss, and unemployment. This could further hurt the Chinese economy, which recently experienced its lowest economic growth rate in over 27 years. Through investment in offshore coal-based power, China is able to export a share of its coal-based technology and labor that would otherwise go to waste. It is China’s continued foreign investments in these emission producing industries that constitute China’s exported emissions.

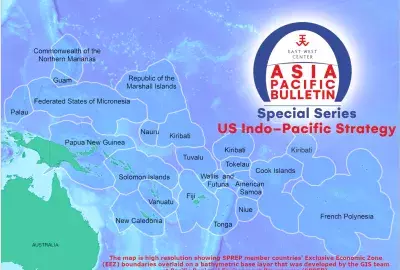

Carbon emissions from Southeast Asia still remain small on a global scale, however, Southeast Asia is the fastest-growing region for carbon emissions worldwide. According to a recent report by Tsinghua University, if Belt and Road Initiative countries continue their current infrastructure investment patterns, they could account for 50 percent of global emissions by 2050. This makes reinventing the way we assess a country’s climate goals crucial in the fight to slow the effects of climate change in Southeast Asia and the Pacific Islands. As China races to reach its Paris Agreement goals, exported emissions need to be assessed and monitored as part of every country's climate impact. While China has made huge strides domestically, they have put developing nations at risk by investing in outdated and increasingly non-viable coal-based energy technologies.

|

Amy Namur, Young Professionals Program participant at the East-West Center in Washington, explains that “Often, China’s investments in coal-based infrastructure go against a country's national interest." |

Once known as the world's top carbon polluter, China has recently recommitted itself as a leader in sustainability and renewable energy. Moving to fill the gaps left by the United States at the Paris Climate Talks, China has ramped up its renewable energy commitments, including plans to cap its CO2 emissions, drastically increase forest stocks, and expand its non-fossil fuel market share to 20 percent, all by 2030. This move has been highly favorable for Chinese diplomatic relations with its Southeast and Pacific Island neighbors who have labeled climate change as a top priority. Domestically the extensive health impacts of air pollution in China has rallied public opinion against the pollution industry, making the move to green energy both a wide berth of support. While still the highest CO2 emitting country in the world, China has made significant investments in renewable energy development and currently leads the planet in renewable investments abroad. China’s domestic commitment to sustainability has been ambitious; however, meeting these goals has created one of the biggest energy paradoxes of the 21st century.

China’s economic growth continues to be heavily dependent on coal. As reported by the Center for Strategic and International Studies (CSIS), coal made up about 70 percent of the PRCs energy consumption between 1985 and 2016. With coal-fired energy producing up to twice as much CO2 as other fossil fuels, reliance on coal as a primary energy source can be costly in terms of CO2 emissions. According to data from the European Union (EU), China’s CO2 emissions made up just under 30 percent of the global total in 2017, making China’s emissions for the year greater than Africa, Latin America, and the European Union combined. For a country that produces over 3.53 billion tons of coal annually, slowing domestic production would not only put 2.3 million coal miners out of work by 2020, but also drastically harm China’s stagnating economy. In order to combat this, the PRC has adopted an unusual strategy: the exportation of carbon emissions.

Through the use of infrastructure investments, the PRC has been able to utilize its Belt and Road Initiative to invest in coal-based energy production throughout Southeast Asia, the Middle East, and Africa. Between 2000 and 2017, the Chinese Development Bank and the Export-Import Bank of China has financed $52 billion worth of coal projects overseas, effectively backing over one-quarter of all coal plants under development outside of China today according to data from Boston University's Global Development Policy Center. While foreign investments in renewable energies have certainly been on the rise for China, reaching $44 billion in 2017, they have yet to eclipse the PRC’s continued investments in coal.

Often, China’s investments in coal-based infrastructure go against a country's national interest. The Lamu Coal Power Station in Kenya, which was under construction by Power China and funded through Chinese banks, highlights this trend. For a country that has no preexisting coal-based infrastructure, the Lamu Power Station was a costly enigma. Not only would the power station increase Kenya’s greenhouse gas emissions by an estimated 700%, the plant would also be reliant on imported coal, making the power station far from viable. Today, construction of the Lamu Coal Power Station is stalled due to community and national intervention; however, the same cannot be said for Pakistan, which opened its doors to its first coal-fired power plant in 2019 due to similar investments from the PRC.

In Vietnam, Chinese firms have already built 15 coal-fired power plants, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA). Vietnam's decision to abandon its cleaner-burning nuclear power program in favor of coal-fired power can be linked to increasing Chinese investments in coal-based energy such as a recent investment in a 1.75 billion coal-fired power plant in Vinh Tan by China Southern Power Grid and China Power International Development Company. China’s involvement in Bangladesh has also reached new highs. As of May 2019, Chinese investments accounted for an estimated 78 percent of the country’s predicted coal-fired capacity in 2022. This amounts to 18.4 gigawatts of coal-fired energy production according to new figures by Greenpeace. However, as Bangladesh reaches the onset of an energy glut, the future of these projects is still uncertain.

As found by the IEEFA report, the biggest lenders for these coal-based projects are Chinese policy banks such as China Development Bank and China Export-Import Bank, with some investment backing coming from smaller state-owned commercial banks like the Bank of China. State-owned corporations such as the State Grid Corporation of China and China Energy Engineering Corporation are also key developers for out of state coal-based energy investments. These companies often act as engineering, procurement, and construction (EPC) contractors who typically take over operations once construction is finished. Additionally, these EPCs often employ a majority of Chinese workers leading to low levels of local job creation which can lead to conflicts, as seen in Indonesia in 2016.

As China works to meet its Paris agreement goals, an excess of domestic coal-based technology, infrastructure, and labor has started to accumulate within the PRC. If left within China, these assets have the potential to lead to massive opportunity costs, economic loss, and unemployment. This could further hurt the Chinese economy, which recently experienced its lowest economic growth rate in over 27 years. Through investment in offshore coal-based power, China is able to export a share of its coal-based technology and labor that would otherwise go to waste. It is China’s continued foreign investments in these emission producing industries that constitute China’s exported emissions.

Carbon emissions from Southeast Asia still remain small on a global scale, however, Southeast Asia is the fastest-growing region for carbon emissions worldwide. According to a recent report by Tsinghua University, if Belt and Road Initiative countries continue their current infrastructure investment patterns, they could account for 50 percent of global emissions by 2050. This makes reinventing the way we assess a country’s climate goals crucial in the fight to slow the effects of climate change in Southeast Asia and the Pacific Islands. As China races to reach its Paris Agreement goals, exported emissions need to be assessed and monitored as part of every country's climate impact. While China has made huge strides domestically, they have put developing nations at risk by investing in outdated and increasingly non-viable coal-based energy technologies.