Arunrat Chumroentaweesup, Consulting Manager at Tractus Asia, explains that “American firms enjoy two significant benefits. First, US entities are permitted to maintain a majority shareholding or to wholly own a company, branch office or representative office located in Thailand. Second, US companies are permitted to engage in business on almost the same footing as Thai firms and are exempted from most of the foreign investment restrictions imposed by the Foreign Business Act.”

Introduction

Thai-US bilateral relations can be traced back more than 198 years. However, relations have undergone radical transformations since their genesis. The Treaty of Amity and Economic Relations was signed in 1833 and amended later in 1966. It is a special economic relationship that gives special rights and benefits to US business entities in Thailand. American firms enjoy two significant benefits. First, US entities are permitted to maintain a majority shareholding or to wholly own a company, branch office or representative office located in Thailand. Second, US companies are permitted to engage in business on almost the same footing as Thai firms and are exempted from most of the foreign investment restrictions imposed by the Foreign Business Act.

Investment

Inflow into Thailand In 2020, the United States invested $5.6 billion in Thailand. These investments accounted for 11% of the total FDI inflow into Thailand, being eclipsed by only Japan (12%) and China (17%). US FDI inflow into Thailand significantly increased this year, expanding by 49% from the previous year. Conversely, FDI from China only rose by 2% and FDI from Japan shrank by 27%. It is worth noting that among Thailand’s top five FDI providers, the United States is the only source market outside Asia. The top three business sectors for US FDI were wholesale and retail trade – repair of motor vehicles and motorcycles, financial and insurance activities, and real estate activities.

Outflow from Thailand Similarly, since 2017, the US is the third largest recipient of Thai FDI–accounting for $6.3 billion or 9% of Thailand’s total FDI outflow in 2020. It declined by 22% from the previous year. However, the amount of Thai direct investment abroad has been more than the US FDI inflow into Thailand. The top three business sectors for Thai FDI were financial and insurance activities, manufacture of chemicals and chemical products, and wholesale and retail trade – repair of motor vehicles and motorcycles.

Trade

In terms of trade, there is no bilateral Free Trade Agreement (FTA) between Thailand and the United States. It was initiated and negotiated in 2004, aiming at reducing and eliminating barriers to trade and investment between the two nations. However, FTA negotiations have been put on hold since 2006 after the dissolution of the Thai parliament and the coup. Despite this complication, bilateral trade values continue to increase.

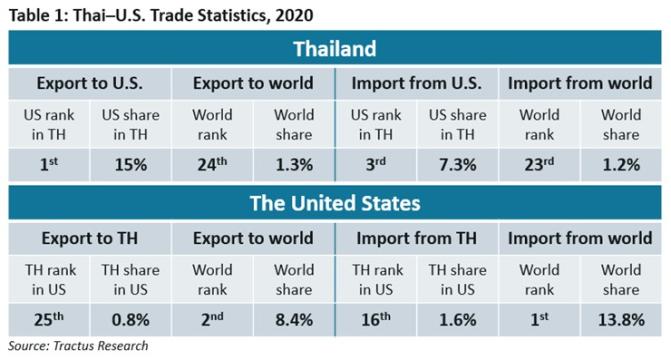

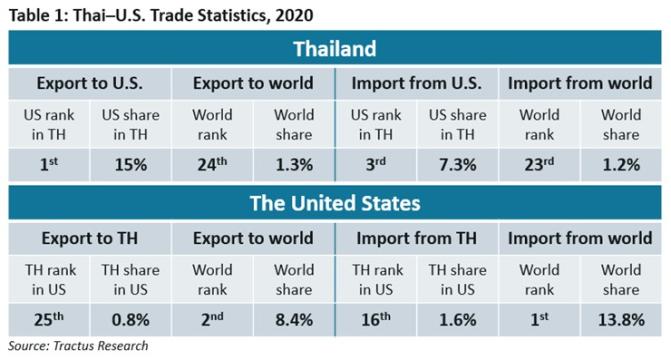

Thailand As shown in Table 1, in 2020, the US was Thailand’s number one goods export destination, followed by China and Japan. Thailand was a net goods exporter to the United States. From 2019 to 2020, the value of Thai exports to the United States has risen 9% to $34 billion. As the destination for 15% of Thai exports, the United States is Thailand’s largest export market, whereas China and Japan accounted for 13% and 10% of Thai exports, respectively. The top three products that Thailand exported to the United States were hard disk drives, proprietary format storage devices, and new pneumatic rubber tires used for motor cars.

In 2020, the US market was Thailand’s third largest source for imported goods, after China and Japan. The value of goods imported from the United States dropped 14% from 2019 and was at $15 billion or 7.3% of Thailand’s imports, while Chinese and Japanese goods captured 24% and 13% of the Thai import market, respectively. The top three products that Thailand imported from the United States were crude petroleum oils, tanks and other armored fighting vehicles, and electronic integrated circuits parts.

The United States In 2020, the United States had a trade deficit with Thailand. Thailand was the 25th largest destination for exports from the United States, capturing 0.8% of US exports. Conversely, 1.6% of U. imports were Thai goods, making Thailand the 16th largest provider of imports to the United States.

Benefits

Undeniably, US businesses in Thailand have benefited considerably from the Treaty of Amity as they can wholly own companies and are exempted from certain restrictions of the Foreign Business Act. At the same time, US FDI provides critical capital for Thai industries to expand and is a boost to domestic businesses. Investment from the United States will eventually increase Thailand’s economic growth and job creation.

An additional benefit is technology and knowledge transfer. US businesses in Thailand also bring in the latest technologies and provide job training to Thai employees. These exchanges serve to advance the development of Thailand’s human capital.

Challenges

The fact that political instability in Thailand has not deterred foreign investors' confidence bodes well for the future of US-Thai commerce. According to the Thailand Board of Investment’s annual Foreign Investor Confidence Survey (2020), 77% of investors expected to maintain their current investment level and 19% had plans to expand their investment in Thailand.

A challenge Thailand may face is profit repatriation if US businesses are unwilling to reinvest profits back into Thailand. This eventuality would create a huge capital outflow from Thailand. However, this possibility is mitigated by Thailand’s Exchange Control Act, which aims to maintain the stability of Thai baht and monitor capital outflows. The Act permits investments to be repatriated freely but requires supporting documentation such as evidence of sale to an authorized bank.

Recommendation

Finally, the governments of Thailand and the United States should consider resuming FTA negotiations. One of the obvious benefits of reducing and eliminating trade and investment barriers is lower prices. Imported goods will become available at a lower price, allowing local consumers in both countries more affordable access to a variety of products. Additionally, an FTA will increase efficiency. A Thai-US FTA could be a catalyst for making local industries as well as the nation more competitive in the region. During FTA negotiations, both governments need to thoroughly consider the adverse impacts of an FTA and explore ways to mitigate these challenges. In addition, the Thai government may need to provide adequate support to domestic industries to boost competitiveness, particularly training in weaker areas of industrial expertise such as digital economy, e-business, human capital development, and advanced manufacturing.

Arunrat Chumroentaweesup, Consulting Manager at Tractus Asia, explains that “American firms enjoy two significant benefits. First, US entities are permitted to maintain a majority shareholding or to wholly own a company, branch office or representative office located in Thailand. Second, US companies are permitted to engage in business on almost the same footing as Thai firms and are exempted from most of the foreign investment restrictions imposed by the Foreign Business Act.”

Introduction

Thai-US bilateral relations can be traced back more than 198 years. However, relations have undergone radical transformations since their genesis. The Treaty of Amity and Economic Relations was signed in 1833 and amended later in 1966. It is a special economic relationship that gives special rights and benefits to US business entities in Thailand. American firms enjoy two significant benefits. First, US entities are permitted to maintain a majority shareholding or to wholly own a company, branch office or representative office located in Thailand. Second, US companies are permitted to engage in business on almost the same footing as Thai firms and are exempted from most of the foreign investment restrictions imposed by the Foreign Business Act.

Investment

Inflow into Thailand In 2020, the United States invested $5.6 billion in Thailand. These investments accounted for 11% of the total FDI inflow into Thailand, being eclipsed by only Japan (12%) and China (17%). US FDI inflow into Thailand significantly increased this year, expanding by 49% from the previous year. Conversely, FDI from China only rose by 2% and FDI from Japan shrank by 27%. It is worth noting that among Thailand’s top five FDI providers, the United States is the only source market outside Asia. The top three business sectors for US FDI were wholesale and retail trade – repair of motor vehicles and motorcycles, financial and insurance activities, and real estate activities.

Outflow from Thailand Similarly, since 2017, the US is the third largest recipient of Thai FDI–accounting for $6.3 billion or 9% of Thailand’s total FDI outflow in 2020. It declined by 22% from the previous year. However, the amount of Thai direct investment abroad has been more than the US FDI inflow into Thailand. The top three business sectors for Thai FDI were financial and insurance activities, manufacture of chemicals and chemical products, and wholesale and retail trade – repair of motor vehicles and motorcycles.

Trade

In terms of trade, there is no bilateral Free Trade Agreement (FTA) between Thailand and the United States. It was initiated and negotiated in 2004, aiming at reducing and eliminating barriers to trade and investment between the two nations. However, FTA negotiations have been put on hold since 2006 after the dissolution of the Thai parliament and the coup. Despite this complication, bilateral trade values continue to increase.

Thailand As shown in Table 1, in 2020, the US was Thailand’s number one goods export destination, followed by China and Japan. Thailand was a net goods exporter to the United States. From 2019 to 2020, the value of Thai exports to the United States has risen 9% to $34 billion. As the destination for 15% of Thai exports, the United States is Thailand’s largest export market, whereas China and Japan accounted for 13% and 10% of Thai exports, respectively. The top three products that Thailand exported to the United States were hard disk drives, proprietary format storage devices, and new pneumatic rubber tires used for motor cars.

In 2020, the US market was Thailand’s third largest source for imported goods, after China and Japan. The value of goods imported from the United States dropped 14% from 2019 and was at $15 billion or 7.3% of Thailand’s imports, while Chinese and Japanese goods captured 24% and 13% of the Thai import market, respectively. The top three products that Thailand imported from the United States were crude petroleum oils, tanks and other armored fighting vehicles, and electronic integrated circuits parts.

The United States In 2020, the United States had a trade deficit with Thailand. Thailand was the 25th largest destination for exports from the United States, capturing 0.8% of US exports. Conversely, 1.6% of U. imports were Thai goods, making Thailand the 16th largest provider of imports to the United States.

Benefits

Undeniably, US businesses in Thailand have benefited considerably from the Treaty of Amity as they can wholly own companies and are exempted from certain restrictions of the Foreign Business Act. At the same time, US FDI provides critical capital for Thai industries to expand and is a boost to domestic businesses. Investment from the United States will eventually increase Thailand’s economic growth and job creation.

An additional benefit is technology and knowledge transfer. US businesses in Thailand also bring in the latest technologies and provide job training to Thai employees. These exchanges serve to advance the development of Thailand’s human capital.

Challenges

The fact that political instability in Thailand has not deterred foreign investors' confidence bodes well for the future of US-Thai commerce. According to the Thailand Board of Investment’s annual Foreign Investor Confidence Survey (2020), 77% of investors expected to maintain their current investment level and 19% had plans to expand their investment in Thailand.

A challenge Thailand may face is profit repatriation if US businesses are unwilling to reinvest profits back into Thailand. This eventuality would create a huge capital outflow from Thailand. However, this possibility is mitigated by Thailand’s Exchange Control Act, which aims to maintain the stability of Thai baht and monitor capital outflows. The Act permits investments to be repatriated freely but requires supporting documentation such as evidence of sale to an authorized bank.

Recommendation

Finally, the governments of Thailand and the United States should consider resuming FTA negotiations. One of the obvious benefits of reducing and eliminating trade and investment barriers is lower prices. Imported goods will become available at a lower price, allowing local consumers in both countries more affordable access to a variety of products. Additionally, an FTA will increase efficiency. A Thai-US FTA could be a catalyst for making local industries as well as the nation more competitive in the region. During FTA negotiations, both governments need to thoroughly consider the adverse impacts of an FTA and explore ways to mitigate these challenges. In addition, the Thai government may need to provide adequate support to domestic industries to boost competitiveness, particularly training in weaker areas of industrial expertise such as digital economy, e-business, human capital development, and advanced manufacturing.