Error message

|

Courtney Weatherby, Visiting Fellow at the East-West Center in Washington, explains that "Despite significant interest in cooperation on a theoretical level, participating agencies are responsible for pursuing individual and not always complementary mandates." |

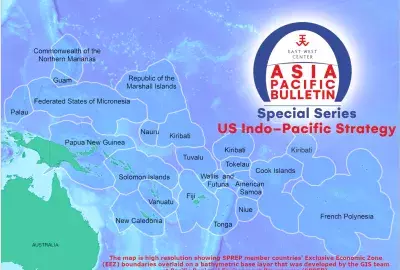

China’s Belt and Road Initiative (BRI) has been the headline response to the vast infrastructure gap that faces developing Asia, especially countries in Southeast Asia. But no country is capable of single-handedly filling the gap, and BRI is prompting other donor governments to give higher priority to infrastructure assistance. Under the Trump Administration, the United States has overhauled its development finance strategy through passing the BUILD Act and establishing various economic initiatives under the Indo-Pacific Strategy. These changes will make the United States a more accessible option for project finance, but collaboration with other donors will be necessary to effectively address the infrastructure gap.

Japan has supported infrastructure development in Southeast Asia for decades, and there is clear and growing political will for the United States and Japan to cooperate. Energy infrastructure has become a particular area of focus because Southeast Asia’s energy sector requires investment of at least $2.7 trillion through 2040. The United States and Japan have taken various steps to facilitate collaboration: in November 2017, President Trump and Prime Minister Abe established the Japan–United States Strategic Energy Partnership to develop open and competitive energy markets and promote universal access to electricity throughout the Indo-Pacific. Shortly afterward, the U.S. Trade and Development Agency and Japan’s Ministry of Economy, Trade, and Industry signed a Memorandum of Understanding (MOU) to bring high-quality and modern energy infrastructure to the Indo-Pacific. In 2018, the Overseas Private Investment Corporation (OPIC) signed MOUs to support high-quality infrastructure and sustainable growth with Japan International Cooperation Agency (JICA) and the Japan Bank for International Cooperation (JBIC).

As of early 2019, these MOUs have not yet resulted in any specific projects or concrete initiatives. Critics might negatively compare this with the list of fifty specific infrastructure projects that Japan and China highlighted in an October 2018 joint statement. However, the list in Xi and Abe’s joint statement was hypothetical and perhaps overambitious — at least one project has already been removed, and others are in exploratory phases and will only move ahead if feasibility studies indicate commercial viability. Japan–United States collaboration may be slow out of the gate, but regular and substantive dialogue is taking place between both government and private sector actors to identify sustainable and economically viable projects.

There are three major challenges that policymakers from the United States and Japan must navigate in order to operationalize collaboration on energy in the Indo-Pacific.

First, there are bureaucratic obstacles. Despite significant interest in cooperation on a theoretical level, participating agencies are responsible for pursuing individual and not always complementary mandates. As government-affiliated aid agencies and financial institutions, their ultimate task is to promote the national brand abroad. Ownership over aid projects is best demonstrated through building coalitions of national companies that can fund, design, and implement projects from start to finish. This reality has created a system geared toward building bridges between national-level private sector actors rather than creating transboundary consortiums. Working-level experts often view joint projects as less attractive because they dilute national branding.

Even when there is a clear advantage to a joint project, differences between American and Japanese agencies in organization, regulatory practices, and eligibility requirements for loans make joint projects difficult to manage. A good example would be eligibility differences between JBIC and OPIC, both of which provide loans to domestically-based companies looking to invest abroad. JBIC (as well as JICA and DFAT) are able to provide direct aid and loans to consortiums with state-owned enterprises, which OPIC is prohibited from doing because SOEs are considered government entities. For the energy sector in particular, this is a challenge because utilities in many Southeast Asian countries are still SOEs.

Second, the United States is currently in the process of overhauling and updating its development finance practices. US government agencies like OPIC and the Export-Import Bank have continuously provided financing for physical projects, but they face limitations due to a US preference for supporting private sector, commercially-viable projects rather than direct government investments. OPIC-supported projects have historically been required to pass requirements of financial viability, meet benchmarks for American ownership, and provide loans in US dollars.

The Trump Administration has addressed some of these limitations by passing the BUILD Act, which will double OPIC’s financial capacity from $29 billion to $60 billion, allow for loan disbursement in local currency, and take a more flexible approach that supports projects benefitting American interests, even if direct US company participation is limited. These changes will address many organizational obstacles and regulatory mismatches with Japanese partners, but the new OPIC — called the U.S. International Development Finance Corporation — is not going to come online until late 2019. Some collaborative projects may be in a holding pattern until then.

Third and perhaps most challenging, the private sector has not yet organically pursued joint venture projects that could take advantage of joint financing. Because the US approach to development finance requires private sector leadership, ultimately the private sector is in the driver’s seat. JBIC and JICA have been actively marketing the US-Japan partnership to companies but — although a few projects are under discussion — none have yet been announced.

It’s not clear that any joint US–Japan consortiums are ready to go. While many Japanese companies invest in infrastructure projects in the Indo-Pacific, they have been active for decades and already have established partnerships with other Japanese companies and local partners. American companies in the region are by and large centered in the manufacturing and service sectors, and largely contribute equipment or technology supplies through the supply chain.

The difficulty in lining up traditional joint-venture projects in the near-term may require policymakers in the United States and Japan to think differently about what collaboration can look like. The BUILD Act relaxed the definition of “American stake” to include American interests more broadly. This opens the door to joint projects which are implemented by Japanese companies but which benefit American businesses up the supply chain. Potential collaboration on LNG ports and other infrastructure is one example: Japanese companies might construct the projects, but the significant benefits gained from selling American LNG to the Asian market could justify OPIC support.

There also may be opportunities to coordinate on projects that US and Japanese actors independently pursue for greater strategic benefit across the board. For instance, Japanese actors often receive JBIC funding for international transmission lines in mainland Southeast Asia. US-based energy companies are involved in renewable energy projects in the region. It could be possible for JBIC and OPIC to coordinate conditional funding on these projects so that Japan-funded transmission lines are designed to bring electricity from US-funded power plants to markets in urban Thailand and Vietnam. This type of complementary investment would both benefit the independent investors and result in more sustainable, high-quality infrastructure for the region as a whole.

|

Courtney Weatherby, Visiting Fellow at the East-West Center in Washington, explains that "Despite significant interest in cooperation on a theoretical level, participating agencies are responsible for pursuing individual and not always complementary mandates." |

China’s Belt and Road Initiative (BRI) has been the headline response to the vast infrastructure gap that faces developing Asia, especially countries in Southeast Asia. But no country is capable of single-handedly filling the gap, and BRI is prompting other donor governments to give higher priority to infrastructure assistance. Under the Trump Administration, the United States has overhauled its development finance strategy through passing the BUILD Act and establishing various economic initiatives under the Indo-Pacific Strategy. These changes will make the United States a more accessible option for project finance, but collaboration with other donors will be necessary to effectively address the infrastructure gap.

Japan has supported infrastructure development in Southeast Asia for decades, and there is clear and growing political will for the United States and Japan to cooperate. Energy infrastructure has become a particular area of focus because Southeast Asia’s energy sector requires investment of at least $2.7 trillion through 2040. The United States and Japan have taken various steps to facilitate collaboration: in November 2017, President Trump and Prime Minister Abe established the Japan–United States Strategic Energy Partnership to develop open and competitive energy markets and promote universal access to electricity throughout the Indo-Pacific. Shortly afterward, the U.S. Trade and Development Agency and Japan’s Ministry of Economy, Trade, and Industry signed a Memorandum of Understanding (MOU) to bring high-quality and modern energy infrastructure to the Indo-Pacific. In 2018, the Overseas Private Investment Corporation (OPIC) signed MOUs to support high-quality infrastructure and sustainable growth with Japan International Cooperation Agency (JICA) and the Japan Bank for International Cooperation (JBIC).

As of early 2019, these MOUs have not yet resulted in any specific projects or concrete initiatives. Critics might negatively compare this with the list of fifty specific infrastructure projects that Japan and China highlighted in an October 2018 joint statement. However, the list in Xi and Abe’s joint statement was hypothetical and perhaps overambitious — at least one project has already been removed, and others are in exploratory phases and will only move ahead if feasibility studies indicate commercial viability. Japan–United States collaboration may be slow out of the gate, but regular and substantive dialogue is taking place between both government and private sector actors to identify sustainable and economically viable projects.

There are three major challenges that policymakers from the United States and Japan must navigate in order to operationalize collaboration on energy in the Indo-Pacific.

First, there are bureaucratic obstacles. Despite significant interest in cooperation on a theoretical level, participating agencies are responsible for pursuing individual and not always complementary mandates. As government-affiliated aid agencies and financial institutions, their ultimate task is to promote the national brand abroad. Ownership over aid projects is best demonstrated through building coalitions of national companies that can fund, design, and implement projects from start to finish. This reality has created a system geared toward building bridges between national-level private sector actors rather than creating transboundary consortiums. Working-level experts often view joint projects as less attractive because they dilute national branding.

Even when there is a clear advantage to a joint project, differences between American and Japanese agencies in organization, regulatory practices, and eligibility requirements for loans make joint projects difficult to manage. A good example would be eligibility differences between JBIC and OPIC, both of which provide loans to domestically-based companies looking to invest abroad. JBIC (as well as JICA and DFAT) are able to provide direct aid and loans to consortiums with state-owned enterprises, which OPIC is prohibited from doing because SOEs are considered government entities. For the energy sector in particular, this is a challenge because utilities in many Southeast Asian countries are still SOEs.

Second, the United States is currently in the process of overhauling and updating its development finance practices. US government agencies like OPIC and the Export-Import Bank have continuously provided financing for physical projects, but they face limitations due to a US preference for supporting private sector, commercially-viable projects rather than direct government investments. OPIC-supported projects have historically been required to pass requirements of financial viability, meet benchmarks for American ownership, and provide loans in US dollars.

The Trump Administration has addressed some of these limitations by passing the BUILD Act, which will double OPIC’s financial capacity from $29 billion to $60 billion, allow for loan disbursement in local currency, and take a more flexible approach that supports projects benefitting American interests, even if direct US company participation is limited. These changes will address many organizational obstacles and regulatory mismatches with Japanese partners, but the new OPIC — called the U.S. International Development Finance Corporation — is not going to come online until late 2019. Some collaborative projects may be in a holding pattern until then.

Third and perhaps most challenging, the private sector has not yet organically pursued joint venture projects that could take advantage of joint financing. Because the US approach to development finance requires private sector leadership, ultimately the private sector is in the driver’s seat. JBIC and JICA have been actively marketing the US-Japan partnership to companies but — although a few projects are under discussion — none have yet been announced.

It’s not clear that any joint US–Japan consortiums are ready to go. While many Japanese companies invest in infrastructure projects in the Indo-Pacific, they have been active for decades and already have established partnerships with other Japanese companies and local partners. American companies in the region are by and large centered in the manufacturing and service sectors, and largely contribute equipment or technology supplies through the supply chain.

The difficulty in lining up traditional joint-venture projects in the near-term may require policymakers in the United States and Japan to think differently about what collaboration can look like. The BUILD Act relaxed the definition of “American stake” to include American interests more broadly. This opens the door to joint projects which are implemented by Japanese companies but which benefit American businesses up the supply chain. Potential collaboration on LNG ports and other infrastructure is one example: Japanese companies might construct the projects, but the significant benefits gained from selling American LNG to the Asian market could justify OPIC support.

There also may be opportunities to coordinate on projects that US and Japanese actors independently pursue for greater strategic benefit across the board. For instance, Japanese actors often receive JBIC funding for international transmission lines in mainland Southeast Asia. US-based energy companies are involved in renewable energy projects in the region. It could be possible for JBIC and OPIC to coordinate conditional funding on these projects so that Japan-funded transmission lines are designed to bring electricity from US-funded power plants to markets in urban Thailand and Vietnam. This type of complementary investment would both benefit the independent investors and result in more sustainable, high-quality infrastructure for the region as a whole.