Error message

|

Cleo Paskal, Associate Fellow, Chatham House and Director, The Oceania Research Project (protorp.org), explains that “The confluence of major changes in all three of the '3 geos' (geopolitical, geoeconomic, and geo-physical) is making the strategic picture in Oceania increasingly complex.”

|

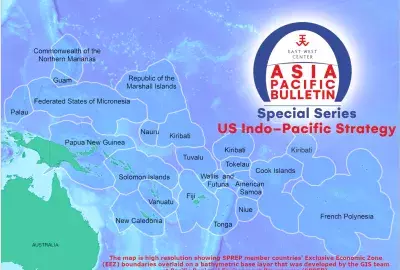

Oceania typically refers to the vast area of the Pacific Ocean covered by Australia, New Zealand, over a dozen Pacific Island Countries (PICs), and a wide range of other dependencies, territories, and affiliated states (including the United States’ Guam, American Samoa, Northern Marianas, Midway, etc...). It covers close to one sixth of the planet’s surface and is the strategic front line between Asia and the Americas.

Throughout the Cold War, from 1945 to the early 1990s, Oceania was considered solidly ‘West-friendly’, with major American and British diplomatic and military engagement in the region. After the end of the Cold War, the general strategic perception was that the area was less critical and reasonably secure. The United States shifted its focus to other zones, and the UK closed several High Commissions in the Pacific Islands. Washington and London largely handed ‘strategic oversight’ of the region to its “Five Eyes” intelligence-sharing partners Australia and New Zealand.

That lack of interest is changing. In the past decade Indonesia, Japan, India and especially France (which has territories in Oceania) have all deepened engagement with PICs.

By far the most effective and disruptive new engagement in the region has come from China. Through soft loans, scholarships, immigration, commercial activity, military-to-military cooperation and diplomatic engagement, Beijing has been taking effective advantage of weaknesses in Western regional policies in order to dramatically widen and deepen its influence in Oceania—including in Australia and New Zealand which have seen high profile cases of Chinese attempts to influence domestic politics and external policies.

China’s influence efforts in Oceania have global implications. Already, hotspots within the “first island chain” include the South and East China Seas where China is building new islands and challenging sovereignty claims of Southeast Asian countries and Japan. The “second island chain”, including Guam, has come under threat from China and North Korea, and is being increasingly militarized. The PICs are largely within the “third island chain” – bricks in the ‘Pacific wall’ China would want to co-opt and control as it seeks to constrain US influence to the line centered on Hawaii.

Also of interest to Beijing, selected countries within Oceania could offer valuable refueling and transshipment hubs for traffic to and from South America. China and France are already in discussions to use French Polynesia as such a hub.

In addition to these geopolitical and geoeconomic shifts, the region is also witnessing unprecedented geo-physical change including severe weather events that are disrupting human security, physical infrastructure and economies. In a recent example, in February 2018, the main island of the Kingdom of Tonga was hit by the strongest cyclone in its recorded history. The Parliament building was destroyed, as were over $150 million in crops.

The confluence of major changes in all three of the ‘3 geos’ (geopolitical, geoeconomic, and geophysical) is making the strategic picture in Oceania increasingly complex. Additionally, in 2018, several scheduled events could have long-term repercussions, including: strategically important New Caledonia holding a referendum on independence from France; elections scheduled in Cook Islands, French Polynesia, Fiji, and the Solomon Islands; Papua New Guinea hosting APEC; and Japan hosting its triennial Pacific Islands Leaders Meeting, with a possible emphasis on maritime security.

Given the changes, Australia and New Zealand are rethinking their role in the region. In early March 2018, the newly elected government in New Zealand announced a “Pacific reset”. If taken seriously, this will be the first time in a decade that Wellington truly reevaluates its regional relationships. The goal will be to assuage what New Zealand Foreign Minister Winston Peters referred to as “strategic anxiety” in Oceania, and for New Zealand to become a true partner for regional countries.

A potential test case for the policy ‘reset’ involves the Pacific Agreement on Closer Economic Relations Plus (PACER Plus) free trade agreement. The deal was hastily pushed through by Australia and New Zealand (the latter under the previous administration) in April 2017. It has yet to be ratified by parliaments of Australia, New Zealand or the nine PICs who signed on. PICs already have mostly duty-free and quota free access to Australia and New Zealand and so it is difficult to see the benefit for them.

PACER Plus is designed to do three things: have PICs drop tariffs for Australian and New Zealand goods; ‘harmonize’ PIC economies with Australian and New Zealand economies; and, as the New Zealand government’s own National Interest Analysis wrote: “preserve New Zealand’s position against major competitors from outside of the region in the years to come” via ensuring that PICs “will pass the benefits of any future liberalization and commitments made in Free Trade Agreements concluded with other partners to New Zealand investors and service exporters due to sound most favored-nation commitments.”

In this case, the ‘other partners’ aren’t China, they are the United States, the European Union, Japan, India and others. PACER Plus is more about increasing PICs’ economic dependence on Australia and New Zealand than about increasing growth in the region.

Under diplomatic pressure, several PICs signed (but have yet to ratify) PACER Plus. The US Freely Associated States (Federated States of Micronesia, Marshall Islands and Palau) have yet to sign, as the deal could disadvantage their economic relations with the US. The large economies of Fiji and Papua New Guinea refused. Fiji objected to the “very restrictive” third party most favored nation clause. Papua New Guinea pulled out saying the deal was in Australia and New Zealand’s favor, a ‘complete waste of time’ and it would ‘kill’ its manufacturing sector.

The push, or lack thereof, for PACER Plus ratification will be a major story to watch in 2018. Ratification has the potential to severely fragment the PICs and weaken PIC economies, opening the door for more Chinese loans (and so strategic leverage) across the region. It could also open the door for Chinese-funded Australian or New Zealand based companies to use PACER Plus to gain access to PICs critical infrastructure, including ports, airports and telecoms.

Whether or not Australia and New Zealand persist in trying to get the deal ratified will show if there is truly a policy reset by Canberra and Wellington, or if the West’s key regional partners in Oceania are reverting to business as usual and putting the interest of narrow domestic economic lobbies ahead of regional growth and security — a model that has failed them, their allies, and the people of the region for too long.

|

Cleo Paskal, Associate Fellow, Chatham House and Director, The Oceania Research Project (protorp.org), explains that “The confluence of major changes in all three of the '3 geos' (geopolitical, geoeconomic, and geo-physical) is making the strategic picture in Oceania increasingly complex.”

|

Oceania typically refers to the vast area of the Pacific Ocean covered by Australia, New Zealand, over a dozen Pacific Island Countries (PICs), and a wide range of other dependencies, territories, and affiliated states (including the United States’ Guam, American Samoa, Northern Marianas, Midway, etc...). It covers close to one sixth of the planet’s surface and is the strategic front line between Asia and the Americas.

Throughout the Cold War, from 1945 to the early 1990s, Oceania was considered solidly ‘West-friendly’, with major American and British diplomatic and military engagement in the region. After the end of the Cold War, the general strategic perception was that the area was less critical and reasonably secure. The United States shifted its focus to other zones, and the UK closed several High Commissions in the Pacific Islands. Washington and London largely handed ‘strategic oversight’ of the region to its “Five Eyes” intelligence-sharing partners Australia and New Zealand.

That lack of interest is changing. In the past decade Indonesia, Japan, India and especially France (which has territories in Oceania) have all deepened engagement with PICs.

By far the most effective and disruptive new engagement in the region has come from China. Through soft loans, scholarships, immigration, commercial activity, military-to-military cooperation and diplomatic engagement, Beijing has been taking effective advantage of weaknesses in Western regional policies in order to dramatically widen and deepen its influence in Oceania—including in Australia and New Zealand which have seen high profile cases of Chinese attempts to influence domestic politics and external policies.

China’s influence efforts in Oceania have global implications. Already, hotspots within the “first island chain” include the South and East China Seas where China is building new islands and challenging sovereignty claims of Southeast Asian countries and Japan. The “second island chain”, including Guam, has come under threat from China and North Korea, and is being increasingly militarized. The PICs are largely within the “third island chain” – bricks in the ‘Pacific wall’ China would want to co-opt and control as it seeks to constrain US influence to the line centered on Hawaii.

Also of interest to Beijing, selected countries within Oceania could offer valuable refueling and transshipment hubs for traffic to and from South America. China and France are already in discussions to use French Polynesia as such a hub.

In addition to these geopolitical and geoeconomic shifts, the region is also witnessing unprecedented geo-physical change including severe weather events that are disrupting human security, physical infrastructure and economies. In a recent example, in February 2018, the main island of the Kingdom of Tonga was hit by the strongest cyclone in its recorded history. The Parliament building was destroyed, as were over $150 million in crops.

The confluence of major changes in all three of the ‘3 geos’ (geopolitical, geoeconomic, and geophysical) is making the strategic picture in Oceania increasingly complex. Additionally, in 2018, several scheduled events could have long-term repercussions, including: strategically important New Caledonia holding a referendum on independence from France; elections scheduled in Cook Islands, French Polynesia, Fiji, and the Solomon Islands; Papua New Guinea hosting APEC; and Japan hosting its triennial Pacific Islands Leaders Meeting, with a possible emphasis on maritime security.

Given the changes, Australia and New Zealand are rethinking their role in the region. In early March 2018, the newly elected government in New Zealand announced a “Pacific reset”. If taken seriously, this will be the first time in a decade that Wellington truly reevaluates its regional relationships. The goal will be to assuage what New Zealand Foreign Minister Winston Peters referred to as “strategic anxiety” in Oceania, and for New Zealand to become a true partner for regional countries.

A potential test case for the policy ‘reset’ involves the Pacific Agreement on Closer Economic Relations Plus (PACER Plus) free trade agreement. The deal was hastily pushed through by Australia and New Zealand (the latter under the previous administration) in April 2017. It has yet to be ratified by parliaments of Australia, New Zealand or the nine PICs who signed on. PICs already have mostly duty-free and quota free access to Australia and New Zealand and so it is difficult to see the benefit for them.

PACER Plus is designed to do three things: have PICs drop tariffs for Australian and New Zealand goods; ‘harmonize’ PIC economies with Australian and New Zealand economies; and, as the New Zealand government’s own National Interest Analysis wrote: “preserve New Zealand’s position against major competitors from outside of the region in the years to come” via ensuring that PICs “will pass the benefits of any future liberalization and commitments made in Free Trade Agreements concluded with other partners to New Zealand investors and service exporters due to sound most favored-nation commitments.”

In this case, the ‘other partners’ aren’t China, they are the United States, the European Union, Japan, India and others. PACER Plus is more about increasing PICs’ economic dependence on Australia and New Zealand than about increasing growth in the region.

Under diplomatic pressure, several PICs signed (but have yet to ratify) PACER Plus. The US Freely Associated States (Federated States of Micronesia, Marshall Islands and Palau) have yet to sign, as the deal could disadvantage their economic relations with the US. The large economies of Fiji and Papua New Guinea refused. Fiji objected to the “very restrictive” third party most favored nation clause. Papua New Guinea pulled out saying the deal was in Australia and New Zealand’s favor, a ‘complete waste of time’ and it would ‘kill’ its manufacturing sector.

The push, or lack thereof, for PACER Plus ratification will be a major story to watch in 2018. Ratification has the potential to severely fragment the PICs and weaken PIC economies, opening the door for more Chinese loans (and so strategic leverage) across the region. It could also open the door for Chinese-funded Australian or New Zealand based companies to use PACER Plus to gain access to PICs critical infrastructure, including ports, airports and telecoms.

Whether or not Australia and New Zealand persist in trying to get the deal ratified will show if there is truly a policy reset by Canberra and Wellington, or if the West’s key regional partners in Oceania are reverting to business as usual and putting the interest of narrow domestic economic lobbies ahead of regional growth and security — a model that has failed them, their allies, and the people of the region for too long.